The Rise Of E-Wallets In The Philippines

Digital wallets have become such an essential part of daily life in the Philippines that imagining a world without them feels almost impossible. By 2025, the country is expected to surpass 80 million registered e-wallet accounts, marking a threefold increase in just five years.

- The Rise Of E-Wallets In The Philippines

- A Financial Revolution in Motion

- How the E-Wallet Landscape in the Philippines Is Evolving

- Challenges Along the Way

- The Top E-Wallets in the Philippines

- GCash

- Maya

- GrabPay

- ShopeePay

- Coins.ph

- Choosing the Right E-Wallet for You

- 2. For Rewards and Deals

- 3. For Security and Banking Features

- 4. For Cross-Border and Crypto Use

- From Wallets to Wealth

According to the 2024 Visa Consumer Payment Attitudes Study, the Philippines ranks second in Southeast Asia in e-wallet usage, at 87%, just behind Indonesia’s 92%. From paying bills to sending money and shopping online, Filipinos are rapidly embracing this digital revolution.

A Financial Revolution in Motion

E-wallets are now the most used online financial service in the Philippines, surpassing digital banking and online lending platforms. Their market value is projected to reach USD $4.42 billion by 2025 and USD $6.20 billion by 2029, growing at a CAGR of 8.8%.

This growth isn’t just about convenience, it’s reshaping how people handle money. The shift towards cashless payments represents one of the most significant financial transformations in Philippine history.

How the E-Wallet Landscape in the Philippines Is Evolving

A major reason behind this growth is accessibility. As of early 2024, over 70% of Filipinos owned smartphones, and the country had 142 million mobile connections, showing that many people use more than one SIM card. With internet penetration at 83.8%, digital finance has become widely accessible.

The rise of Gen Z and millennial users, who value speed and convenience has accelerated this trend. Combined with a booming e-commerce sector expected to hit USD $4.3 trillion by 2025, e-wallet adoption has soared.

Government programs like QR Ph and the National Retail Payment System (NRPS) have also been key drivers, creating a secure and regulated digital payment ecosystem. As a result, digital retail payments jumped from 10% in 2018 to 52.8% in 2023, a dramatic change in consumer behavior.

Even rural areas are now joining this shift, as e-wallets extend their reach to provinces and remote communities.

Challenges Along the Way

Despite rapid progress, some challenges remain. Many Filipinos still struggle with financial literacy, limiting their ability to use advanced features like investments or credit. Cybersecurity risks, including phishing and online scams, are also growing.

Moreover, in areas where internet connectivity is weak or smartphone access is limited, people still depend on cash. However, e-wallet providers continue to innovate, developing offline features and partnering with local agents to reach more users.

The Top E-Wallets in the Philippines

GCash

GCash remains the market leader with over 60 million users. Operated by Mynt (a joint venture of Globe Telecom, Ayala Corporation, and Ant Group), GCash offers far more than just digital payments.

Users can open GSave accounts, borrow through GCredit, or invest via GInvest—bringing banking services to millions. Its wide merchant acceptance, from big retail chains to sari-sari stores and tricycle drivers, makes it deeply integrated into everyday Filipino life.

There are even talks of a future GCash IPO, which would mark a major milestone in Philippine fintech.

Maya

Formerly known as PayMaya, Maya has transformed into a full digital bank offering savings, credit, and cryptocurrency services. With over one million banking customers, it stands out for its up to 6% annual interest rate on savings and BSP-backed security.

Maya is especially appealing to small and medium enterprises (SMEs), offering QR payment systems, invoice tools, and credit options that help businesses grow.

GrabPay

GrabPay is part of the Grab super-app ecosystem, making it a natural choice for millions who use GrabFood, GrabCar, and GrabMart.

While it focuses more on daily lifestyle payments than banking, GrabPay’s integration across multiple services ensures strong user engagement. It’s also expanding financial offerings like microloans and insurance through Grab Financial Group, helping users without formal credit histories access essential financial tools.

ShopeePay

ShopeePay is tightly linked with Shopee’s e-commerce platform, excelling in cashbacks, vouchers, and shopping rewards. It’s especially popular during major online sale events like 9.9 and 11.11.

In 2023, ShopeePay grew its offline QR payment network, allowing users to pay bills and top up mobile phones. While it lacks savings or credit features, it’s perfect for online shoppers seeking convenience and value.

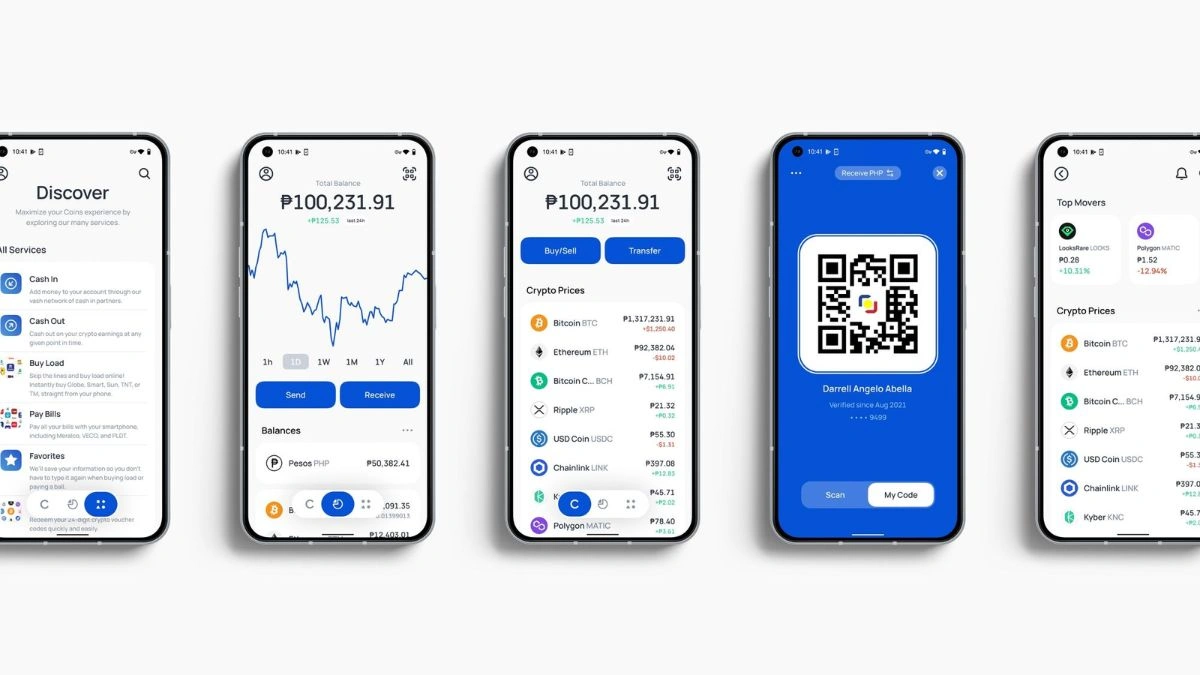

Coins.ph

Coins.ph has carved out a niche as the leading crypto-friendly wallet in the Philippines. It enables users to buy, sell, and store cryptocurrencies alongside regular e-wallet features like bill payments and remittances.

Licensed by the Bangko Sentral ng Pilipinas (BSP) as a Virtual Currency Exchange, it’s especially trusted among freelancers and overseas Filipino workers (OFWs). Since its acquisition by the Gokongwei Group in 2022, Coins.ph has doubled down on crypto and Web3 innovation, bridging traditional and decentralised finance.

Choosing the Right E-Wallet for You

1. For Everyday Use

If you want an all-purpose wallet for bills, transfers, and daily expenses, GCash is the best choice. GrabPay is also useful if you often use Grab’s transport or delivery services.

2. For Rewards and Deals

ShopeePay and GrabPay are ideal if you enjoy earning cashbacks, vouchers, and discounts, especially during sales or in-app promotions.

3. For Security and Banking Features

For those who value security and regulated banking, Maya is the top option. With BSP oversight, it provides reliable banking services, savings, and credit.

4. For Cross-Border and Crypto Use

Coins.ph is best for managing crypto transactions or sending money abroad, making it especially popular among OFWs and freelancers.

Most Filipinos today use two or more e-wallets to enjoy different features—whether that’s rewards, convenience, or banking services. Think of it as creating your own digital finance toolkit to match your lifestyle.

From Wallets to Wealth

The e-wallet revolution in the Philippines is just beginning. These platforms are expanding into insurance, microloans, and investments, helping more people achieve financial inclusion.

With partnerships involving barangay centers, sari-sari stores, and telecom agents, even rural communities are gaining access to digital finance. The BSP’s goal of 90% financial inclusion is now within reach.

Yet, challenges remain, especially in digital literacy, cybersecurity, and regional connectivity. Overcoming these hurdles will require collaboration between fintech companies, the government, educators, and local communities.

Ultimately, the question is no longer whether e-wallets will replace cash, but how they will help more Filipinos build secure, connected, and prosperous lives in a digital economy.

Also Read- How ChatGPT Can Now Connect With Spotify, Booking.com, And More